A Small Step Toward A Fairer Tax System

When it comes to legislative sausage-making, there’s an old political maxim worth remembering: Do not let perfect be the enemy of the good.

That came to mind last week as the Senate voted to zero-out the state grocery tax – a public policy winner for workaday Oklahomans and the least among us.

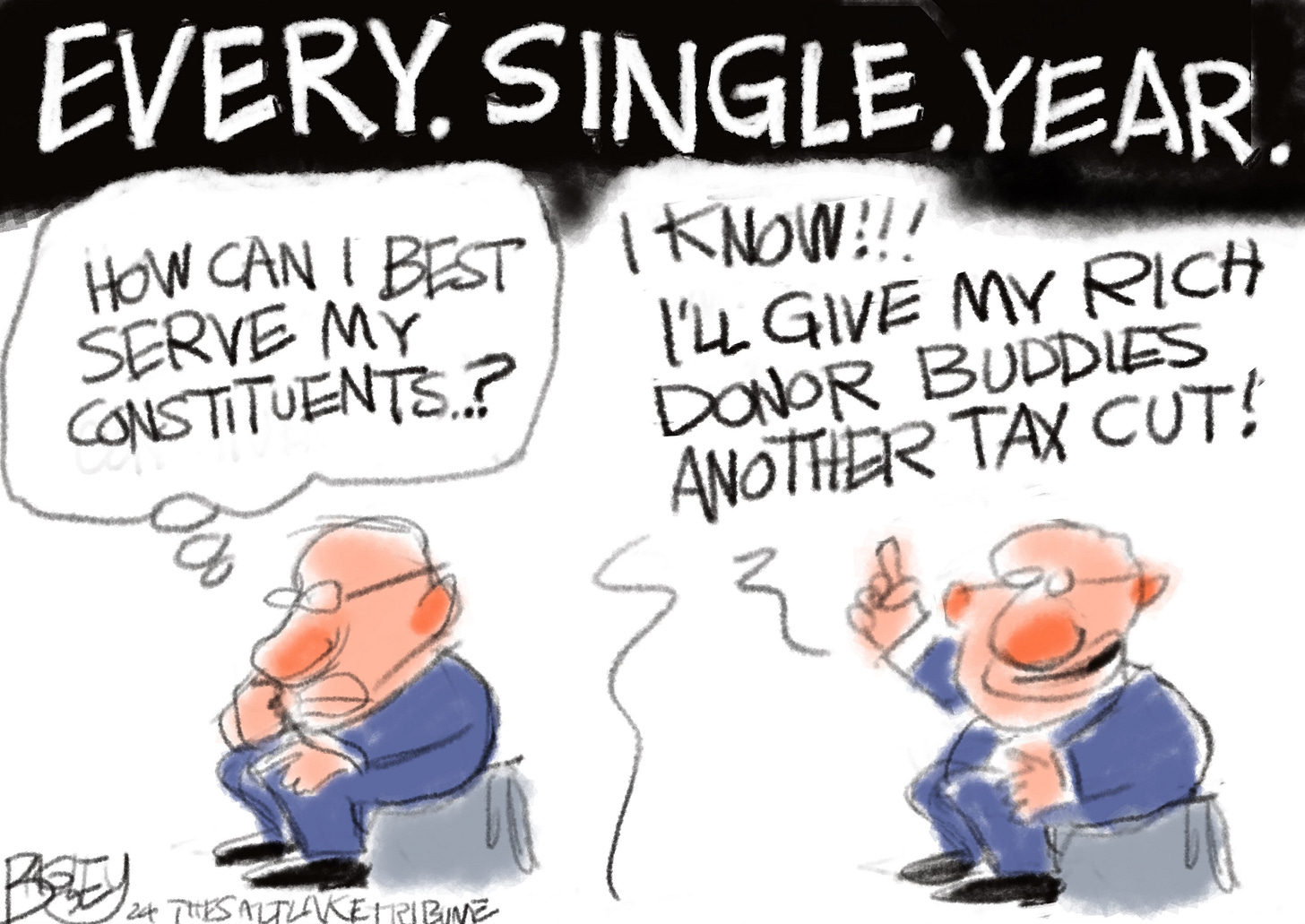

The House approved it last year. And the governor has promised to sign any tax cuts reaching his desk. But you can bet some of the state’s biggest checkbooks will bemoan that senators refuse to cut the state income tax rate as well.

Gov. Kevin Stitt and House Speaker Charles McCall had hoped to see another .25 percentage point cut this session, citing the state’s solid [for the moment] fiscal picture. For those with six- and seven-figure incomes, it would be a windfall. For median income Oklahomans, the equivalent of a couple of Happy Meals a month.

By contrast, dropping the grocery tax from 4.25% to zero provides working class Oklahoma families real relief from soaring pandemic-era prices – an estimated $700 in annual savings. The income tax cut would save most Oklahomans about $110 a year.

While the grocery tax cut is projected to cost the state treasury $400 million-plus annually, some of the loss is likely to be offset when workaday families discover more discretionary money in their budgets, right?

“To be clear: this is the only tax relief the Senate will be seeking this year,” Senate President Greg Treat said. “To ensure state services and recent critical investments in education and infrastructure remain intact in the long and short term, there is no way to do more at this time.”

That will be disputed, of course, by those who want to eliminate the state income tax completely – to be more [in their words] like Texas. But such rhetoric ignores the reality that Texas offsets absence of an income tax with higher property rates and sales taxes.

In this case, Treat and Co. are siding with workaday Oklahomans – the folks who really keep the economy going [sorry, trickle-downers]. Indeed, Treat hailed his colleagues for “not giving in to cheap political wins or rhetoric that would have put the state on the wrong fiscal path” – but rather for choosing a “common sense” approach that “will help everyone.”

This is where the warning “do not let perfect be the enemy of the good” comes in.

Yes, zeroing out the state grocery tax is good news for workaday taxpayers. But let’s be clear: it’s no silver bullet given that cash-strapped municipalities could seek to raise their sales taxes on groceries after 2025, effectively wiping out the good state lawmakers are doing now.

The real problem is, municipalities are forced under current state law to rely primarily on sales taxes to fund operations and capital improvements. As the largest single revenue source for many towns, the grocery tax almost certainly will be an inviting target. Sooner, rather than later.

Which means the Senate’s action affords a golden opportunity to consider a broader question: How to fully – and fairly – fund vital government operations at all levels in the 21st century.

As Senate Democratic Leader Kay Floyd put it, “We need a long-term structure that will give our citizens certainty about how those policies will impact their finances, as well as the critical functions of government Oklahomans rely on, such as public education, health, mental health, public safety, infrastructure, and other vital services.”

Floyd is spot on. What Oklahoma truly needs is comprehensive tax reform, something that should have been undertaken years ago.

To do it right takes time. It can’t be accomplished without serious heavy-lifting – not kind of performance politics the governor pursues by calling special session after special session.

There is no time like the present for Oklahoma’s elected elite to begin the exhaustive work necessary to build a fairer, more sustainable tax code.