Oklahoma Is Ready To Fail Its Next Stress Test

Oklahoma legislators recently received a report showing the state’s revenue remains at risk from even a minor economic hiccup and that we haven’t saved enough money to maintain services until revenue rebounds, which would take several years. That means our already under-funded and under-performing public services, like schools and colleges, law enforcement, roads and highways, and the safety net that too many of us depend on, will only get worse.

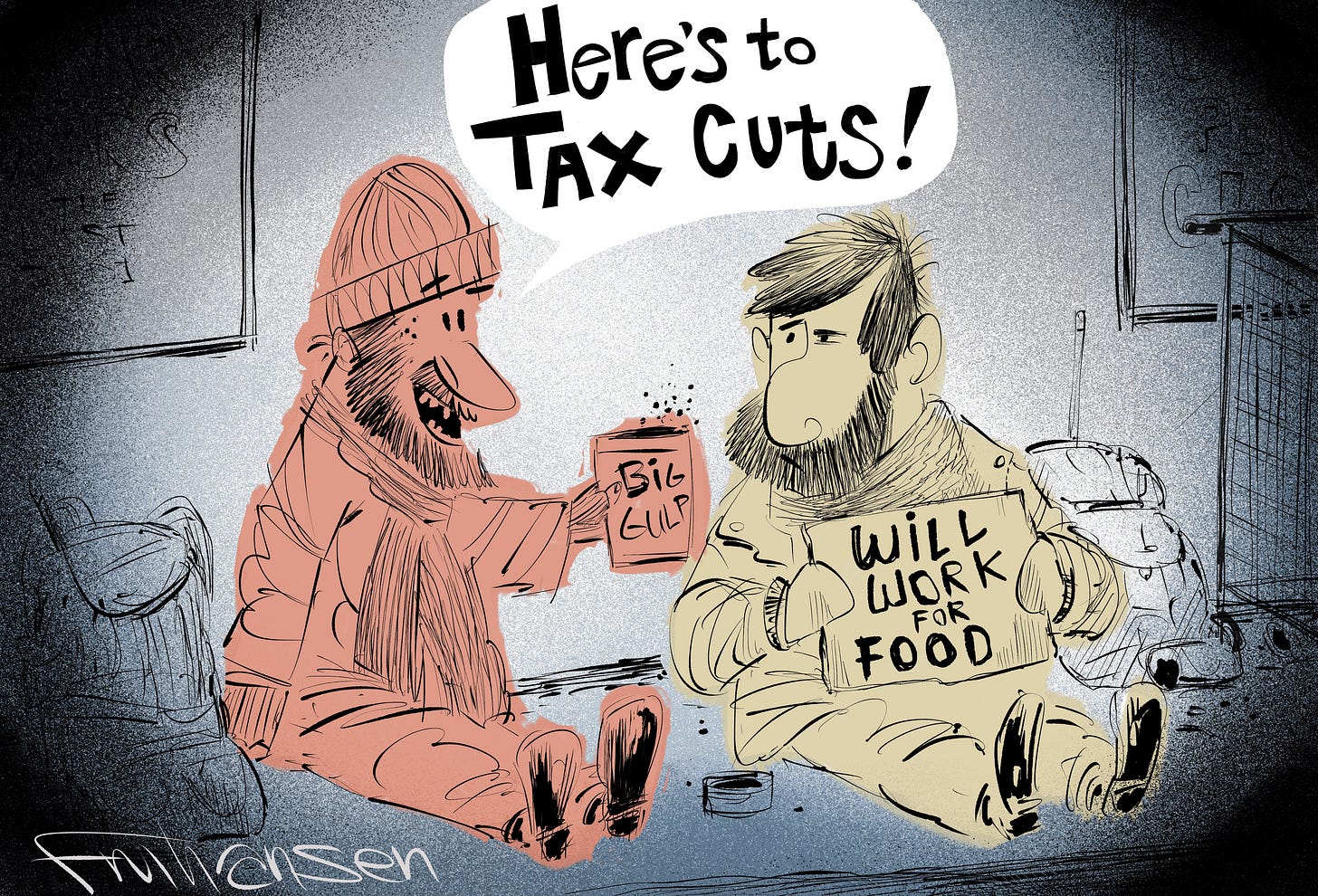

While a few of our elected leaders expressed concern, none had suggestions, a few were dismissive, and too many stand ready to pour some [Oklahoma-produced] oil on the fire by approving unneeded and ill-advised tax cuts.

We deserve better and we should demand our leaders focus on making our state government more resilient and reliable.

Oklahoma’s Legislative Office of Fiscal Transparency [LOFT] was created in 2020 to investigate issues in state financial and related policy as directed by an oversight committee of legislators. The Budget Stress Test report is an example of some of LOFT’s best work. The report convincingly demonstrates Oklahoma is not ready for an economic downturn and that we need to end our continuous tax cuts and shrinkage of the state government.

Unfortunately, our fiscal future [and the state services we all demand and depend on] depends on legislators picking up and acting on those signals, which would be welcome but seems unlikely.

Here are five takeaways from a reading of the report and the committee meeting at which it was presented:

1. In any economic downturn, the state will lose more revenue than it has saved for emergencies. LOFT contracted with Moody’s Analytics to evaluate Oklahoma’s economic outlook and its impact on state revenues. LOFT staff summarized it succinctly: “Oklahoma is best positioned to manage a mild downturn but not worse.”

In a “mild” economic downturn, state revenues could drop by over $3 billion over the five years. In a severe one, the loss could be nearly $10 billion, or roughly one year’s worth of revenue.

While the state has more emergency funds than in most past years – $1.7 billion – that’s only enough to make up for half the income we’d lose in a mild recession, and it wouldn’t even make a dent in the losses from a severe downturn. The downturns aren’t hypothetical either.

Since 1980 we’ve had three recessions that are mild to moderate and one – the 1980s oil bust – that was on the border between moderate and severe.

2. It’s even worse than that sounds. The revenue losses above are understated, for three reasons.

First, the forecasts of revenue growth are pretty rosy given our history and our propensity for reducing taxes. Second, any but the mildest recession could take more than five years for full recovery [up to 15 years for a severe downturn], so the total revenue losses [and service cuts] are higher than the numbers. Third, the forecasts aren’t adjusted for inflation. Just like everyone, government faces inflation, except in the most severe recessions. That means even in a mild

recession when revenue recovers to the pre-recession level in five years, it will fall well short of funding all the services we depended on before things turned down. Considering that we rank 40th in state tax levels and – some coincidence! – in the Bottom 10 states in most aspects of public service and well-being, we really can’t afford for things to get worse at all, much less a decade!

3. Some elected officials get it, but most don’t. One might expect our legislators to take this warning seriously and talk about how to respond to it. Sen. Roger Thompson, R-Okemah, the budget chair, asked good questions that suggested he grasps the risks we face, but offered no ideas. Along with Senate President Pro Tem Greg Treat, R-Edmond, Thompson has worked hard to protect the state’s revenue base against constant efforts by Gov. Kevin Stitt and the House of Representatives to gut the tax base. House Budget Chair Kevin Wallace, R- Wellston, ably represented the kill-government crowd by dismissing the whole exercise: “ … there’s a lot of things we can maneuver … in the heat of the moment there are very creative minds that can get in the room and come up with a balanced budget.”

A balanced budget isn’t the issue. Half a dozen or more shrinking budgets is the issue. Whether Wallace didn’t understand the report or doesn’t care is open to interpretation, but it could also be both.

4. Our entire fiscal system is a mess and is putting all of us at risk. LOFT noted we have handcuffed ourselves into constant fiscal turmoil. We have an unstable revenue base. While our economy is the second most diversified in our region, our tax base is the second least diversified. That means when things go south, state revenue takes a bigger hit in Oklahoma than elsewhere. It’s also easy for legislators to cut taxes but hard to raise them [which requires 75% of legislators or 50% of taxpayers to approve]. Because of these factors, Oklahoma has ridden a fiscal roller coaster. We’re continuously surprised and unprepared for revenue shortfalls and each new trough is lower than the one before.

There have been eight revenue failures – when revenues fell short of forecasts and state agency budgets were cut mid-year – since 2000. That makes it harder to depend on public services and it helps explain why, adjusted for inflation and population growth, the state budget is 12% lower than in 2000, in spite of strong budget growth in the last two years.

5. Our leaders have a plan to make it worse. Stitt has built his governorship on cluelessness and he’s staying on brand this year, calling a third special session to cut taxes, even though the regular session is just a few days away. Legislators ignored his first two calls and will certainly do so this time as well. However, the House continues to favor any tax cut regardless of need or fiscal condition.

Oklahomans should demand an end to this ridiculousness. Taxes aren’t high in Oklahoma – our state and local taxes are 10th lowest in the country and second lowest in the region. We’ve also emphatically disproven the idea that cutting taxes improves the economy. Since 2000 we’ve cut the top income tax rate from 7% to 4.75%. In that time our economy has not exactly soared; we’ve moved up from 46th highest output per person to 43rd.

Stitt and legislators should concentrate on solving problems and making Oklahoma more stable and prosperous rather than hurting everyone and everything in the state except their election chances.

LOFT did Oklahomans a service by providing a clear, fact-based look at the damage we’ll face in the next economic downturn. It’s unfortunate that they didn’t offer suggestions for legislation to improve our fiscal policies and conditions and that legislators don’t seem to have ideas, either. The one thing we can guarantee will make it worse – another tax cut – is the issue that will get the most attention this year.

There’s a lot of work to do, but in the meantime those who understand the absolute necessity of public services for functioning families, communities, and states can draw the line on tax cuts and demand legislators pay some attention to the long game.