Tax-Free Social Security Income? Not Exactly

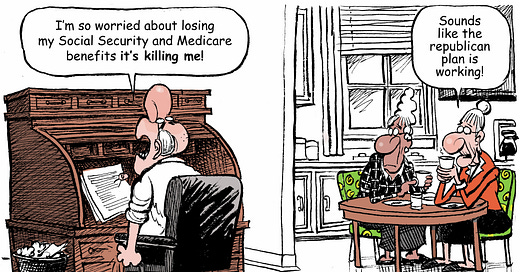

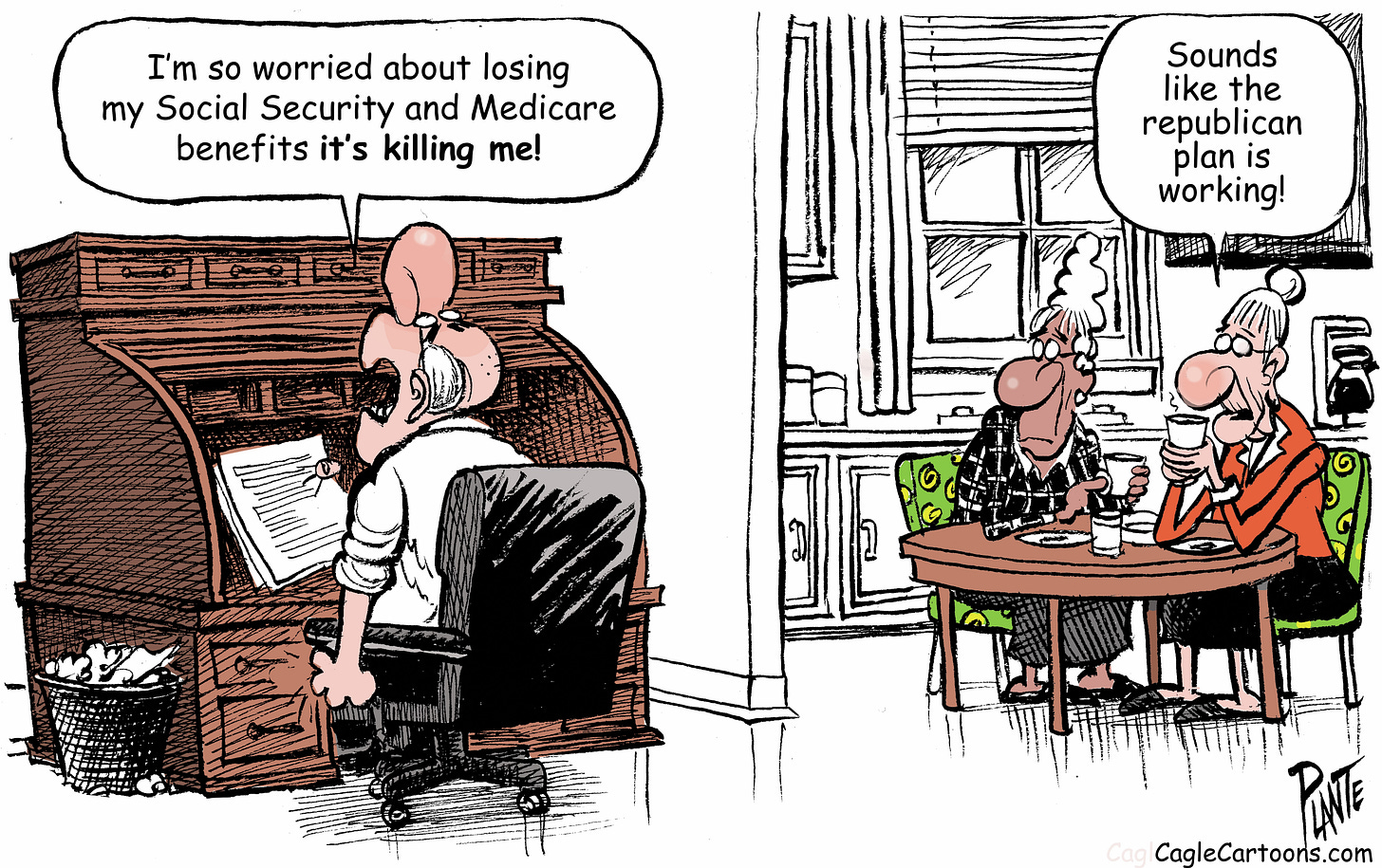

Since President Trump signed the "big" policy bill of his dreams into law on Independence Day, the White House and the Social Security Administration [SSA] have been misleading the public about its impact on Social Security income.

The White House trumpeted, "No Tax on Social Security is a Reality." In an email SSA sent to millions of Americans, they wrote that the "new law ...eliminates federal income taxes on Social Security benefits for most beneficiaries."

Does it, though?

In reality, the enacted "big bill" does not eliminate Social Security income tax. For most 65-plus seniors, it does reduce their taxable income with a new deduction. Income tax will still be calculated on Social Security benefits, but for about 88% of recipients, the new deduction will exceed the amount of taxes owed, zeroing out their tax bill. The deduction applies to their adjusted gross income. Social Security recipients whose taxable income is at the high end will still be required to pay whatever tax amount the new deduction does not offset. [Low-income Social Security beneficiaries – about 22% of them – already pay no income taxes on their benefits due to not meeting the minimum taxable threshold of annual income.]

This new $6,000 "seniors deduction" will go to taxpayers age 65 and older. People who are receiving Social Security at an earlier age [an option starting at age 62] will still have to pay taxes on their income – without the deduction – until they turn 65.

In addition to the age limitation, the deduction to offset seniors' tax burden also has income limitations. Taxpayers whose adjusted gross income for the year exceeds $75,000 will still pay taxes on their income, including Social Security. [For couples filing jointly, the ceiling for getting the full $6,000 deduction is $150,000.] "Above these income levels," as a New York Times article explains, "the deduction begins to decrease, and it goes away once single taxpayers' income reaches $175,000 [$250,000 for couples]."

Social Security income per se remains taxable. For the purposes of this deduction, it is combined with other income for those who have it. This means the tax burden will be reduced for seniors' income from investments, employer pensions, traditional IRAs, and all other taxable income in addition to Social Security, as long as their total adjusted gross income is not more than $75,000 per individual. The deduction would even go to seniors without any Social Security income, offsetting taxes on their other sources of income.

The tax deduction is based on age and annual income, not specifically on receiving Social Security. "There is no provision in the budget bill that directly 'eliminates' or even reduces taxes on Social Security benefits," Howard Gleckman, from the nonpartisan Tax Policy Center, told the Washington Post. The administration is downplaying this.

They are also downplaying another reality. This tax deduction for eligible seniors is temporary. The new law authorizes it through 2028. It then expires. This stands in stark contrast to the much more costly billionaires' tax cut, which is permanent.

Many would support a simple, straight-forward tax exemption for Social Security income. I would, in fact, depending on how it's set up and its impact on the budget as a whole. It is a depressing disappointment that the closest we're getting is neither simple nor straight-forward. Worse, it is attached to an overall policy agenda that will add hardship to millions.

BUT WHY??

This raises a question: why did Congress do it this way? Why create an income tax deduction to seniors' total income instead of simply eliminating income tax on Social Security benefits like they're trying to make it sound like they did? Instead of distorting the truth, the administration's claims of making Social Security income tax-free would then be true!

To pass the "big bill," Republicans had to make it filibuster-proof so Democrats alone couldn't defeat it. If it included eliminating Social Security income taxes outright, the whole bill would require 60 votes to pass in the Senate instead of 51. Besides, Trump had made it clear how thrilling he found the idea of "one big, beautiful bill." Accommodating Trump became more important than eliminating Social Security income taxes – if that was, in fact, the goal.

They came up, then, with this tax deduction for seniors. This would not make the massive bill subject to filibuster, so it could – and did – pass with a simple majority. Had they crafted a separate bill truly eliminating Social Security income taxes, it may well have passed with bipartisan support. But this would have diminished the Republicans' political theater.

LET'S FIX IT

If certain hypotheticals were in place, I would support making Social Security income tax-free for people of modest means. But the truth remains:

- Despite the administration's claims, the temporary senior tax deduction just signed into law does not actually do this;

- The new tax relief for seniors is imbedded in a law that promises to harm millions of Americans;

- If Congress is serious, they need to spend the next two years before this relief expires crafting a stand-alone Social Security reform bill that can pass bipartisan scrutiny;

- To be responsible, making SSA income tax-free needs to be coupled with an effective strategy for the program's long-term sustainability.

FRAILTY, THY NAME IS SOLVENCY

Whether it's [untruthfully] touted as tax-free Social Security income or [as the facts support] a deduction that will temporarily lower many seniors' income taxes, the "one big bill" fails to address the proverbial pachyderm in the room: Social Security's looming insolvency.

For how many years – how many decades – have we been warned about the time left before Social Security's well runs dry? It is "projected to have enough dedicated revenue to pay all scheduled benefits ... until 2034." Axios reports that the new $6,000 senior tax deduction will hasten that by one year: "If no changes are made between now and 2033, the trust fund will run out."

There is a remedy for this bleak situation. In fact, there are competing remedies.

This elephant in the room – Social Security's looming insolvency [and some possible solutions] – will be the subject of my next column, "Social Insecurity." Readers, stay tuned!